brookfield properties stock canada

At Brookfield we are invested in long-life high-quality assets and businesses around the world. Beyond the floor plans.

Brookfield Asset Management Bam Financial Services Real Estate Renewable Power Infrastructure Youtube

In January 2022 Brookfield Property Partners was valued at 73 billion.

. Brookfield Real Estate Services Inc. In addition the Company has interests in. Registered holders with questions related to their.

Beyond the square feet. Its last market close was 1879 an increase of 163 over the previous week. And its subsidiary Brookfield Property REIT Inc is one of the worlds premier real estate.

News information and stories for BROOKFIELD CANADA OFFICE PROPERTIES Toronto Stock Exchange. Get information about Brookfield Property dividends and ex-dividend dates. Brookfield Renewable Partners might be one of the best renewable energy stocks on the TSX if not the world.

Brookfield Properties is a North American subsidiary of commercial real estate company Brookfield Property Partners which itself is a subsidiary of alternative asset management. Brookfield Property Partners through Brookfield Property Partners LP. BROOKFIELD CANADA OFFICE PROPERTIES TSEBOXU.

You can find more details by going to one of the sections under this page such as ex-date dividend and payment. Canada Real Estate Development Projects Brookfield Properties. Brookfield Property REIT stocks BPYUUS are listed on the NASDAQ and all prices are listed in US Dollars.

The market cap is 1700. Business Profile of Brookfield Real Estate Services BRE Companys Full Name. Stock quote stock chart quotes analysis advice financials and news for share BROOKFIELD CANADA OFFICE.

BROOKFIELD CANADA OFFICE PROPERTIES. A 34 billion dollar bill. Our signature properties not only define skylines in Calgary Ottawa and Toronto but are also true destinationsbringing.

How Much Is Brookfield Properties Worth. Brookfield Canada Office Properties announced on June 30 2017 the close of its going private transaction with Brookfield Property Partners. It produces 20 GW of clean energy and is one of the.

The Companys diversified portfolio includes interests in over 300 office and retail properties encompassing approximately 250 million square feet. Brookfield Real Estate Income Trust Brookfield REIT applies a flexible approach to identify quality assets across properties and real estate-related debtregardless. Brookfield Property Partners pays Quarterly dividends to shareholders.

Brookfield Real Estate Services. A fully integrated developer we have the experience and expertise to get the job done right. When was Brookfield Property Partnerss most recent dividend payment.

Brookfield Properties Wikiwand

Brookfield Inside The 500bn Secretive Investment Firm Financial Times

Brookfield Property Partners Lp Won T Remain Undervalued Forever

Brookfield Canada Office Properties Crunchbase Company Profile Funding

Is Brookfield Property Partners Stock A Buy The Motley Fool

Brookfield Property Reit Stock Forecast Up To 26 270 Usd Bpyu Stock Price Prediction Long Term Short Term Share Revenue Prognosis With Smart Technical Analysis

Why Brookfield Property Partners Bpy Stock Is A Compelling Investment Case

Buy Sell Or Hold Brookfield Property Partners Bpy Un T Stock Predictions At Stockchase

Brookfield Property Partners Preferreds Promise Higher Returns Seeking Alpha

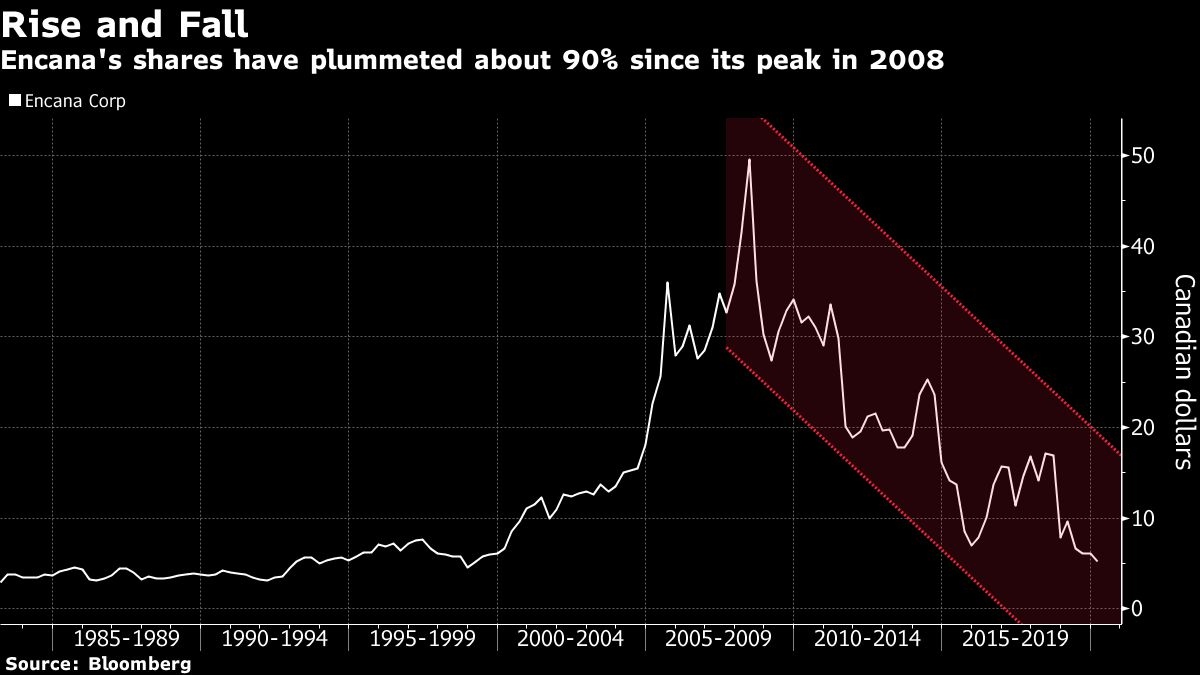

Farewell Encana Hello Brookfield Property In Canadian Index Rejig Bnn Bloomberg

Brp Ca Brookfield Residential Properties Inc Profile Description Canada Stock Channel

Parting Ways With Brookfield Property Partners Investing Par Excellence

Reits Continue Big Rebound After Covid Dip Rbc S Blair Renx Real Estate News Exchange

Brookfield Asset Management Stock Analysis

Canada Real Estate Development Projects Brookfield Properties

/cloudfront-us-east-1.images.arcpublishing.com/tgam/KNQSWA4ZNVECPJNTA5Z2TUZW6Y.JPG)

Brookfield To Buy Remaining Stake In Brookfield Property Partners For 6 5 Billion The Globe And Mail

Bam Brookfield Asset Management Inc Cl A Stock Overview U S Nyse Barron S

Rank Brookfield Office Properties Inc Preferreds Canadianpreferredshares

Brookfield Offers To Take Brookfield Property Private For 5 9 Billion